TT Premium Order Types

TT Prowler order

Overview

TT Prowler Premium Order Type behaves as an enhanced Iceberg order type that allows the user to customize values such as the minimum and maximum amounts to show in the market.

The TT Prowler order type is a liquidity seeking strategy that aims to reduce market impact by avoiding displaying the full order size or by selectively crossing the spread. Combines features of Random Iceberg, PEG, and Sniper type algorithms.

Note At this time, TT Premium Order Types are not available in the Prod-SIM environment.

Prerequisites

Enabling User's Access

Prior to using any TT Premium Order Type, your administrator must enable access by updating the settings at the user level in the User Account Permissions settings or at the account level using the Account Restrictions settings in Setup.

Setting the Order Cross Prevention Rules

TT strongly recommends that accounts both enabled for the TT Premium Order Types and using account-level Order Cross Prevention, should utilize the Cancel Resting (wait for ACK) option to avoid parent orders from being cancelled.

Using the Reject New option may cause parent orders to be cancelled due to excessive rejects preventing the order from progressing.

The Cancel Resting (wait for ACK) option may have child orders receive unsolicited cancels if interacting with Order Cross Prevention, and this will result in new orders being issued in place of those which were cancelled. The unsolicited cancellations will not result in a cancellation of the parent order.

For more information on Order Cross Prevention Rules, refer to the Order Cross Prevention section of the Setup help.

Note Firms may consult with their TT Onboarding representative with any questions regarding how these settings may impact their overall account structure.

TT Prowler order parameters

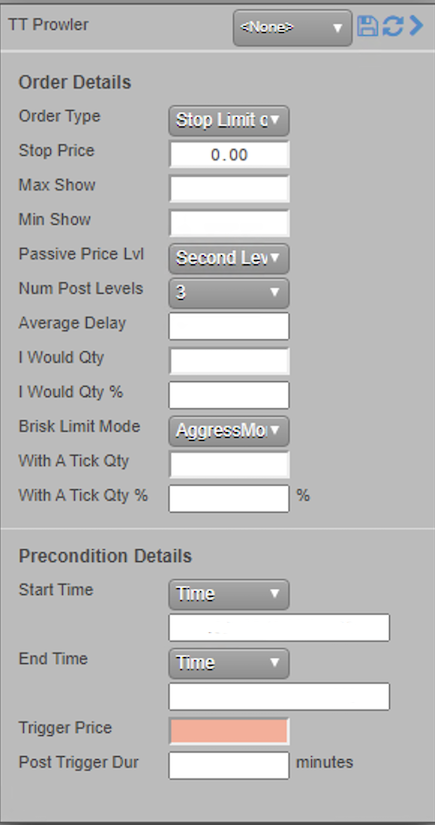

Order Details parameters

Note Some of the parameters listed below are optional and provided so you can enhance and customize the execution of your orders in the market.

| Parameter Name | Required/Optional | Description | Default Value |

|---|---|---|---|

| Order Type | Required | Sets the order type for the parent order. Possible values include: | Market |

| Stop Price | Conditional | The desired stop order's price level. Note: Required when Order Type is set to either Stop Market or Stop Limit. |

0 |

| I Would Price | Optional | Price at which you would like to aggressively attempt to fill your order, regardless of the algorithm logic. Order aggressively tries to fill if the instrument reaches this price, irrespective of volume based tracking objectives. Should be lower than limit and arrival time ask prices for BUY orders, higher than limit and arrival time bid prices for SELL orders. |

Null |

| I Would Qty | Optional | When set to any value greater than 0, I Would Qty setting equals the minimum top of book quantity required before the order will cross the spread. When used, the I Would Qty parameter behaviors may cause an order to finish materially sooner than base TT Premium Order Type logic would normally determine. |

Null |

| I Would Qty % | Optional | Similar to I Would Qty, but set as a percent of the order quantity. Note The field represents the number as a percent and should not be submitted as a decimal: a value of 70 equals 70%. |

Null |

| I Would Qty Var Pct | Optional | Randomizes the I Would Qty and I Would Qty % thresholds by a specified percent in each direction. Note This field represents the number as a percent and should not be submitted as a decimal. For example, a value of 10 equals 10%. For example, if I Would Qty equals 100 and I Would Qty Variance % equals 20, the I Would Qty behavior will be triggered based on available size being between 80-120, depending on randomized value selected within the variance range. |

|

| Max Spread Cross Ticks | Optional | If greater than 0, an order will not cut or cross a bid-ask spread that is more than the specified amount wide. Note This constraint takes precedence over I Would, With A Tick, Brisk Limit, and Cleanup % behaviors. |

|

| Max Show | Required | Maximum open display size per price level for TT Prowler orders.Can be configured with a value of zero (0) |

|

| Min Show | Optional | Minimum open display size per price level for TT Prowler orders. If Min Show remains blank or set equal to 0, the order always displays the amount of order quantity set by Max Show. Can be configured with a value of zero (0) |

Null |

| Passive Price Lvl | Conditional | Allows optimal behavior to peg orders to passive price levels in the order book. If set to No Pegging, child orders are sent at the full limit price. For other settings, the order will rest passively priced child orders even if the limit price is marketable.

Note: Required when Num Post Levels is changed from the default value. |

No Pegging |

| Num Post Levels | Optional | Specifies the number of price levels at which to post child orders when pegging. When Passive Price Levels is set, additional resting orders may be set at subsequent price levels in order to hold queue priority. Note Can be set to greater than 0 with Passive Price Level set to No Pegging (0). For example, you can statically layer child orders across n Num Post Levels to split up a parent order quantity starting from your limit price without dynamic repricing due to Passive Price Level logic. Note Maximum value is 20. |

Default (Off) |

| Post Ticks Apart | Conditional | Specifies how many minimum price increments apart to space passive orders resting across Num Post Levels. |

|

| Tactical Peg | Conditional | If enabled with Passive Price Level not set to No Pegging (0), avoids posting a passive order at the top of book price level if the order book dynamics are unfavorable. |

|

| Average Delay | Optional | Sets a random delay, in seconds, between sending new orders or replacing existing child orders. |

Null |

| Brisk Limit Mode | Optional | Specifies whether the order should get more aggressive when opposite side quote price is at the limit price. This setting can be used to manage fill rate risk, increasing the expected fill rate if the market is nearing the limit price, at the cost of higher expected slippage on executed quantity. Possible values include:

|

Default (Off) |

| With A Tick Qty | Optional | Sets the size threshold to initiate aggressing orders to cross the spread and take liquidity when the opposing quote size falls to or below the set value. The order will cross the spread when aggressive quote size falls to or below the value set by With A Tick Qty. |

Null |

| With A Tick Qty % | Optional | Similar to With A Tick Qty, but expressed as a percent of the order quantity. Note : The field represents the number as a percent and should not be submitted as a decimal: a value of 70 equals 70%. |

Null |

| Cleanup Pct | Optional | Specifies maximum percent of parent order quantity to cross the market with if a parent order is not yet complete near the end time. |

Precondition Details parameters

| Parameter Name | Required/Optional | Description | Default Value |

|---|---|---|---|

| Start Time | Required | Sets the date and time to start executing the synthetic order. Available settings include:

|

Now |

| End Time | Required | Sets the date and time to stop executing the logic of the synthetic order. Used as an alternative to setting Duration |

|

| If Touched Price | Optional | Enables the inverse of Stop Price functionality: if present, a Buy/Sell order activates once the contra price is less/greater than or equal to If Touched Price. Can be used in combination with Stop and Stop Limit orders for One-Cancels-Other (OCO) type behavior, where an order activates when the market reaches either a profit taking or stop loss price. |

|

| Post Trigger Dur | Optional | The Post Trigger Duration in minutes. If set greater than 0, will adjust EndTime once market reaches Stop Price or Trigger Price to earlier of EndTime or current time plus PostTrigger Duration minutes. |

|

| End Time Override | Optional | Overrides End Time, Duration, or the default with one of several product hours related values. Available options are:

Note: If the current time is in the final continuous trading session of the day Next Session Close and Last Session Close reference the same time. |

None |