TT Setup for X_TRADER Platform Users

Setup Overview for X_TRADER Users

The Setup application on the TT platform serves as the central location for managing your firm's users, accounts, risk, exchange connections, FIX Sessions, and more. Whether you use TT User Setup on the X_TRADER platform to perform user, account, and risk management tasks in a locally hosted or X_TRADER ASP environment, you'll be able to perform the same tasks on TT using the Setup application.

Getting started with Setup as an X_TRADER administrator

The Setup application requires none of the manual installs or upgrades of different software versions required on the X_TRADER platform. To get started, you have to:

- Have internet access and a browser that meets TT requirements

- Accept an invitation to join a company in TT

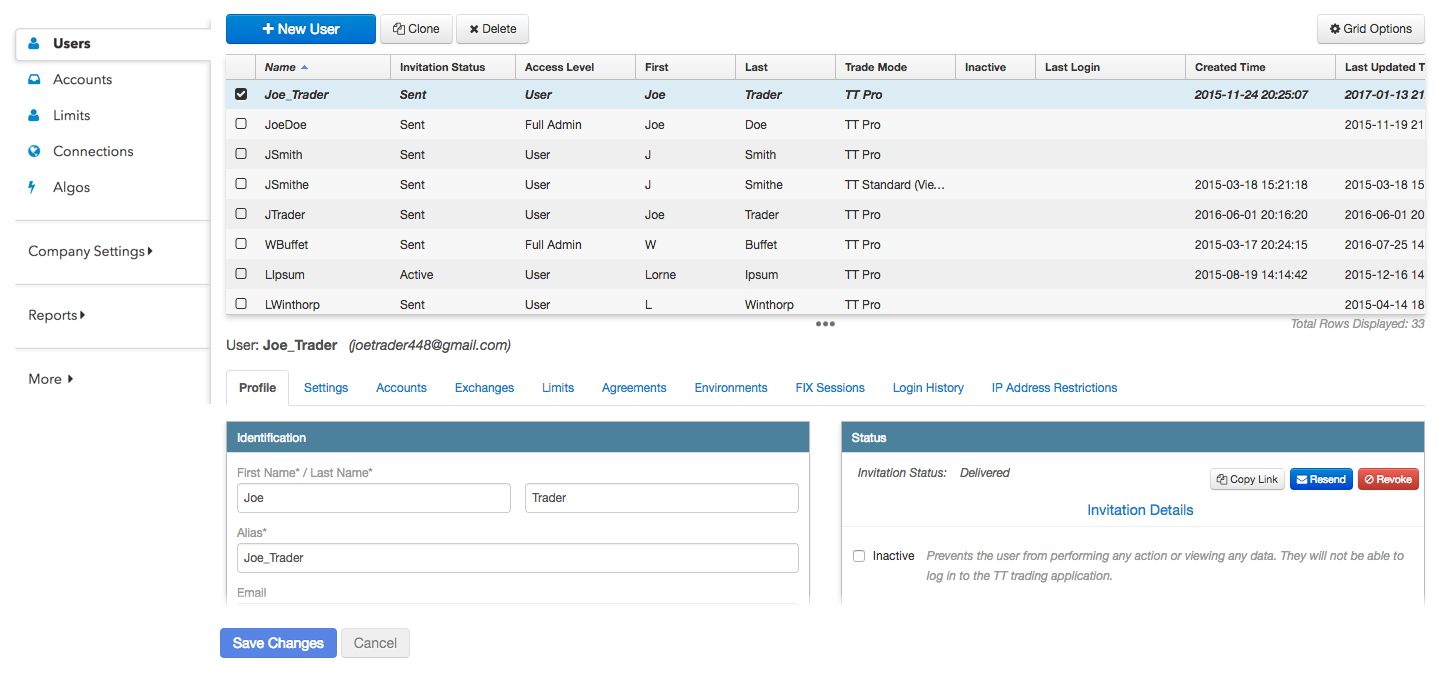

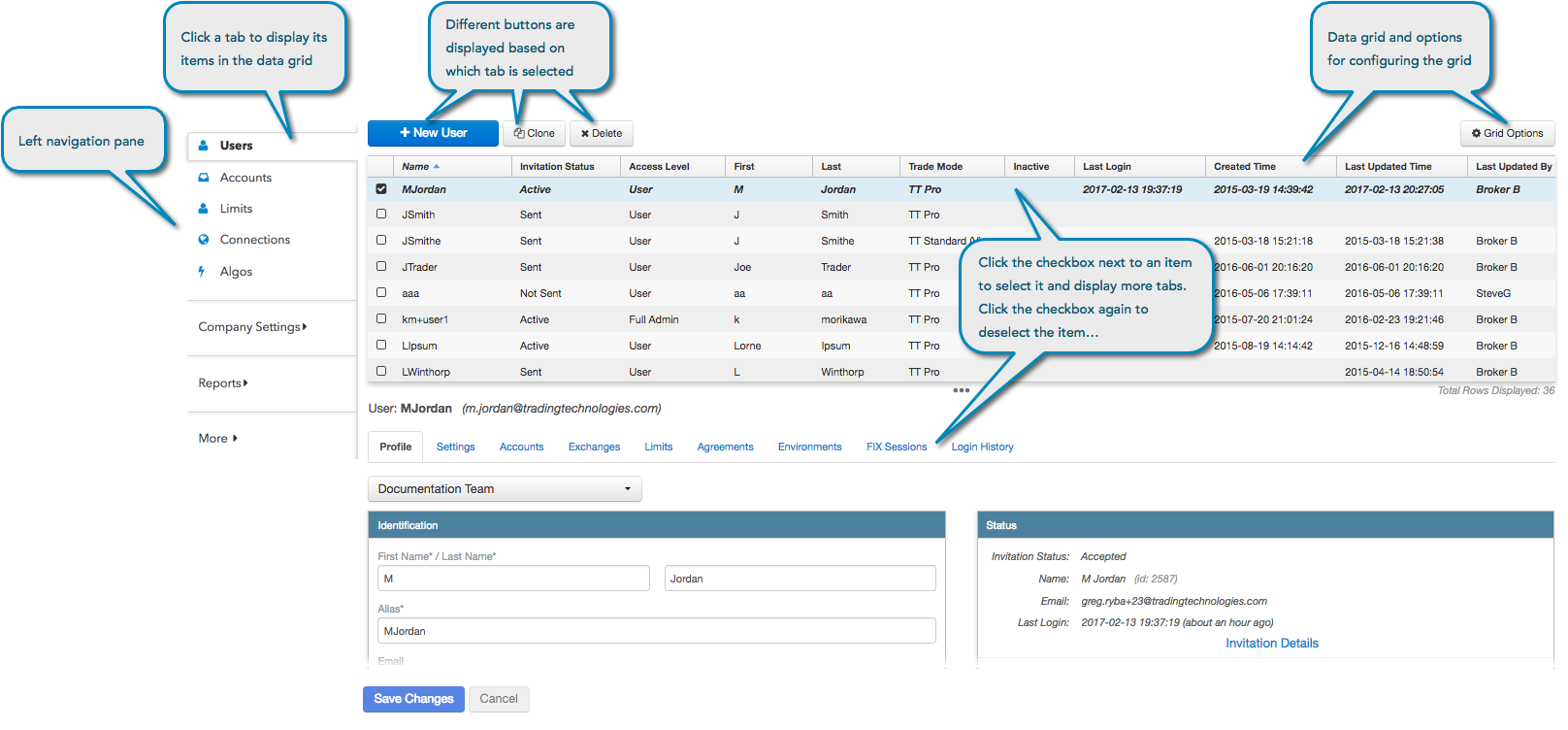

You can access Setup in the Live or Simulation production environments by logging in to setup.trade.tt. When you log in, you'll land on the Users page in the Setup User Interface

Setup for X_TRADER platform users FAQs

Do I need to install and maintain my own TT User Setup database on TT?

On TT, there is no need to install and maintain a separate server and database like you did using TT User Setup on the X_TRADER platform.

After you create your TT account, you'll need to contact Trading Technologies to request that your firm be added as a "company" on the TT platform. TT administrators will then create your company database on TT so that you and your firm can set up users to begin trading in the production environment.

Can I create TTADM users on TT in addition to X_TRADER and administrative users?

Similar to creating administrative users and X_TRADER users, you can also set up users in TT as administrators or individual users. On TT, you can also create administrators for using TT® Score, which is a feature that is only available on the TT platform and allows your firm to leverage machine learning to identify trading behavior that may prompt regulatory inquiries.

The same TTADM permissions on the X_TRADER platform can be replicated on TT by creating a user with view-only admin permissions, and setting account permissions to allow the TTADM user to only delete orders and not submit orders.

How do I create Gateway Logins (MGTs) for connecting to different markets?

On TT, there is no need to create Member-Group-Trader IDs (MGTs) to log in to TT Gateways. The order session credentials that you receive from the exchange can be configured as a "connection" in TT using the Setup application.

Instead of manually configuring TT Gateways, Setup provides GUI-based exchange connection provisioning that can be done by your company administrator. After creating a connection in Setup, you will immediately see the session's status displayed on the Connections screen in Setup.

On the TT platform, exchange connections are made via Order Connector servers in co-located TT data centers that are upgraded and maintained solely by TT support. Each connection in TT is exchange-specific and can be assigned multiple accounts to allow multiple users to access the exchange on a single session.

How are product limits applied if there are no Gateway Logins on TT?

On the X_TRADER platform, an order book was represented by the Gateway Login, and in TT an order book is represented by an account, so the same product risk limits that you set per Gateway Login can also be set per account on TT.

X_TRADER also offered an additional level of risk checking per account. On The TT, this is accomplished using the tiered risk structure for accounts that provides more flexibility than setting up product limits for account groups on the X_TRADER platform.

Account based risk on TT also provides the following functionality that is not available on the X_TRADER platform:

- Shared omnibus accounts

- Account auto-liquidation

- Product family risk for options trading

- Trade permissions can be applied per market based on the account's exchange connection

For more details, refer to Mapping Gateway Login risk to TT.

Are user level risk settings available on TT?

User level risk, which includes pre-trade price controls and price checks, are the same on both platforms with the exception that credit limits are set at the account level on TT and not at the user level. However, the following enhancements have been added to user level risk on TT and are not available on the X_TRADER platform:

- Price reasonability based on percentage

- Price checks during non-matching market states based

- Order rejects when there is no market data

Does Setup provide the capability to configure FIX Adapter servers and clients?

Using Setup, FIX sessions can be configured and assigned to users to connect to TT FIX servers on the TT platform without the need to manually install, configure, and maintain separate FIX Adapter servers and TT Gateways. Your "company's" accounts and users can be assigned to FIX sessions on TT, so there is also no need to configure separate TT FIX Adapter client users like you did on the X_TRADER platform.

In addition, Setup allows you to create FIX Rulesets, which are a set of message and tag rules and symbol mappings that convert messages and tags between TT FIX and FIX clients that use FIX implementations that differ from TT FIX. Each ruleset can also be assigned to a FIX session via the Setup application on TT.

Can I create the same X_TRADER Customer Defaults for users on TT?

On TT, your X_TRADER customer defaults can be created as order tag defaults and given a profile name in Setup. For example, Customer defaults can be set up per account or customer, and define values for specific fields like MiFID II fields.

For more details, refer Order Tag Defaults for X_TRADER Users.

How do I control market data access and order permissions per user in TT?

Setup provides finer market data controls for a user by allowing concurrent market data sessions per market and product. As an administrator, you can allow or block subscriber market data and FIX market data per market and product group, and set how many sessions are allowed per product.

Is there any other Setup functionality in TT that is not available on the X_TRADER platform?

The following features are only available in Setup on the TT platform:

- Shared omnibus accounts

- Pre-trade risk server

- Account auto-liquidation

- Full-tiered risk

- IP address restrictions

- Options family risk

- Data uploads

- TT Premium Services

- Price reasonability by percentage

- Algo permissions

- FIX Order Gateway support

- TT Score permissions

- Advanced options permissions

- REST API support

- Exchange-specific order permissions