TT Setup for X_TRADER Platform Users

Mapping Gateway Login Risk to TT

Product risk limits are set on accounts in TT similar to how risk was set per Gateway Login (MGT) on the X_TRADER platform, so the same product risk limits that you set per Gateway Login can also be set per account on TT. Similar to MGT risk, you can set position limits on TT for futures, options, spreads/strategies, and inter-product spreads using the Setup application on TT.

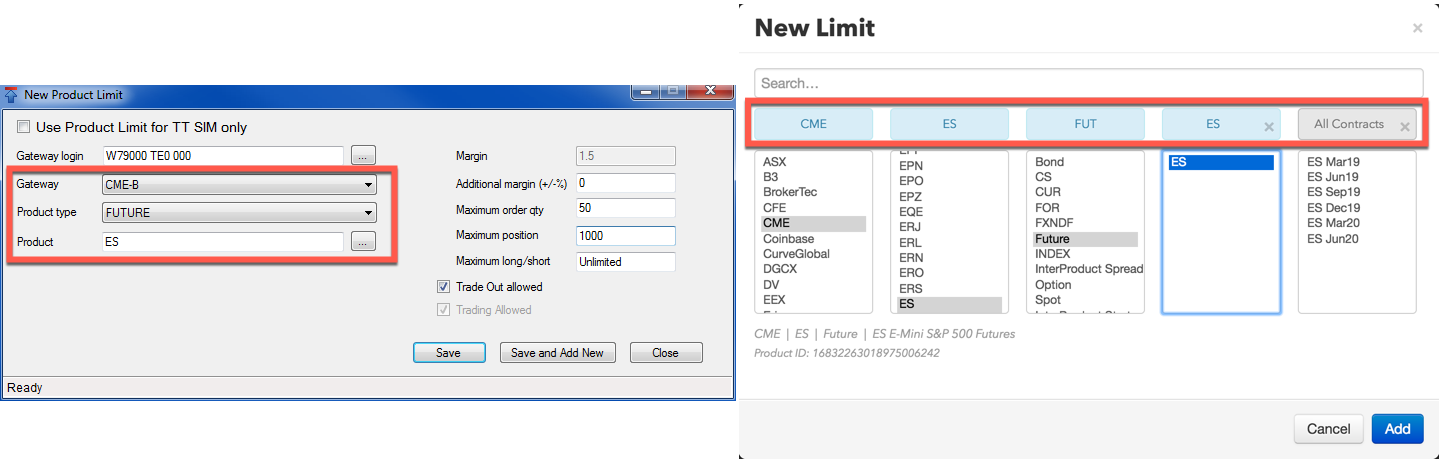

When configuring risk for a Gateway Login, you must first select a TT Gateway for the market you want to trade, as well as select a product type and product on the "New Product Limit" window. This is replaced in TT by the New Limit screen when setting a new position limit.

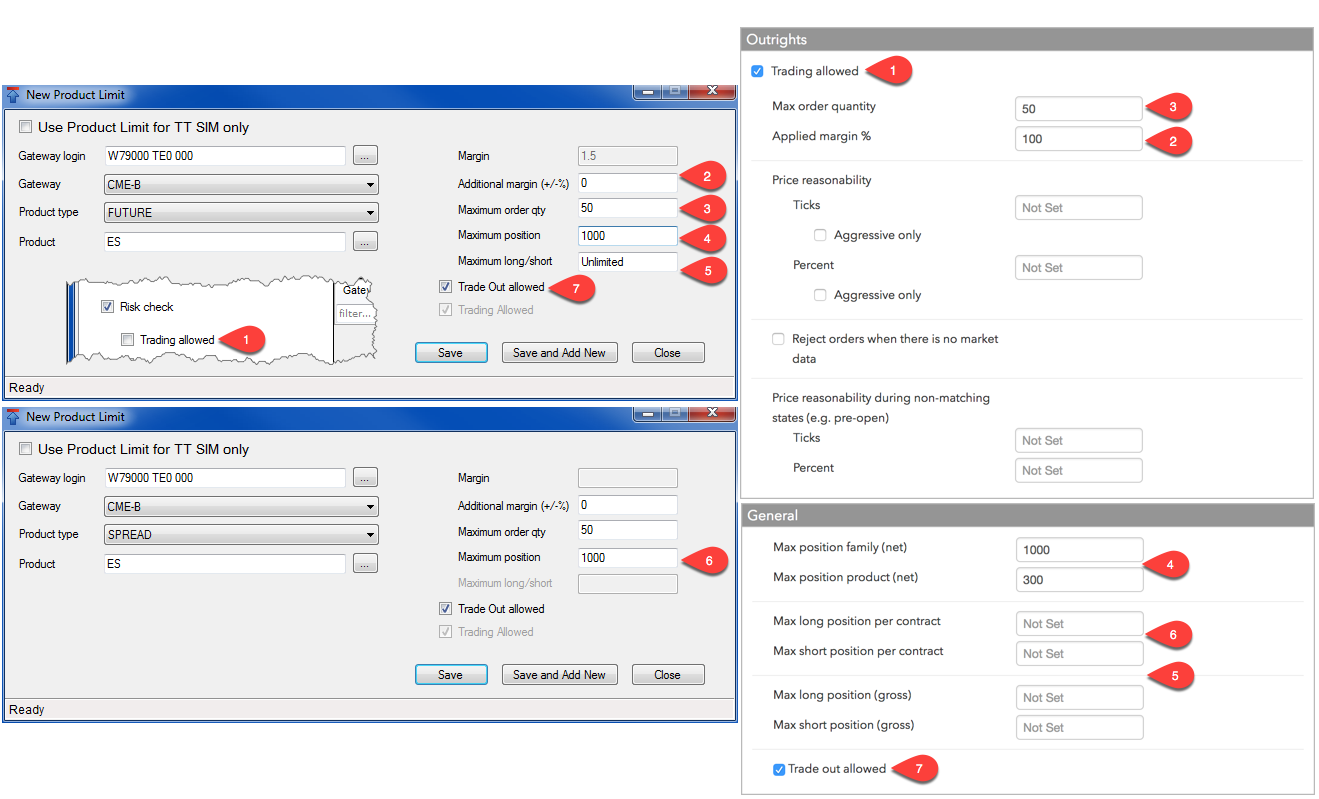

The following diagram and table show how risk settings on the "New Product Limit" window map to the position limit settings on TT:

| No. | Name in 7.17 | Name in TT | Description |

|---|---|---|---|

| 1 | Trading Allowed | Trading Allowed | Specifies whether outrights can be traded for the selected contract. This setting is on the "Edit Gateway Login" window in X_TRADER. For TT, there are separate Outrights settings for all contracts vs. a single contract. If Trading Allowed is unchecked, an order to buy one futures contract would be rejected. However, one spread order might be approved, depending on the “Trading allowed” settings for Spreads/Strategies when setting risk for all contracts (*). For a single contract, you cannot set a margin limit, but you can set maximum position limits. |

| 2 | Additional margin (+/-%) | Applied Margin % | In TT, this specifies a percentage above or below the margin that a trader must have to trade the product. In other words, applied margin increases or decreases the margin requirement when calculating risk limits. Setting this to zero removes margin requirements for this product/contract. This setting is available when setting risk for all futures or options contracts, and applies to both outrights and spreads/strategies. The default setting on TT is 100%. |

| 3 | Maximum order qty | Max order quantity | Specifies a limit on the maximum individual order size that can be entered for the contract. If set for a single contract on TT, this setting overrides the max order qty setting that might exist at the product or exchange level. |

| 4 | Maximum position | Max position family (net), Max position product (net) | The total maximum position allowed across all contracts per product. Long and short positions offset each other (e.g., the limit will never be hit if only calendar spreads are traded). TT provides risk for the product family in addition to risk per product. |

| 5 | Maximum long/short (Futures) | Max long position (gross), Max short position (gross), Max long position per contract, Max short position per contract | The "Max long position per contract" and "Max short position per contract" settings limit an account to an overall maximum long/short position per contract for a product.

The "Max long position (gross)" and "Max short position (gross)" limit the worst case total of long or short contracts per product. The sum of the long positions plus working buy orders in all contracts cannot exceed this limit. For example, if the Max long position limit is four, and there is a long position of two in one contract and a working buy of two in another contract, then no more buy orders can be placed. TT provides the flexibility of separate long and short gross position limits, as well as separate long and short limits per contract. Note: The General screen in TT does not appear when setting risk for a single contract, but you can set maximum long and short positions on the Outrights screen. |

| 6 | Maximum position (Spreads) | Max long position per contract, Max short position per contract | The total maximum position allowed across all contracts per product. Long and short positions offset each other (e.g., the limit will never be hit if only calendar spreads are traded). |

| 7 | Trade Out Allowed | Trade Out Allowed | TT provides a Trade Out capability, which allows the maximum order quantity, long/short position, and credit limits to be exceeded in order to flatten the position in a contract. |

Notes:

- Pre-trade price controls in X_TRADER are available per user and account in TT (e.g., price reasonability settings on the Outrights screen).

- The TT settings are the same for Outrights and Spreads/Strategies when setting position limits for all contracts for a product.

Gateway Login risk for inter-product spreads in TT

To manage position risk on inter-product spreads for a Gateway Login, you must enter separate future and spread position limits for each of the products that comprise that inter-product spread.

On TT, you can set position limits for the inter-product spread itself similar to the account based risk settings on X_TRADER.